The Congress Budget Office [CBO] I have just re -established its budget forecasts at 10 years old – and here they are, they increase their base of tax revenue by 1.9 billion of dollars.

It is the same outfit that has been telling us for years that tax rates always reduce tax revenue and increase the budget deficit. But wait a minute: Trump 2017 tax discounts have been in place for over 7 years. Does the CBO now suggest that they were completely wrong by admitting that the Laffer curve really worked? And has a drop in tax rates produce higher tax revenue? This is what their new forecasts seem to say.

In fact, since President Trump’s huge reduction in the corporate tax rate from 35% to 21%, over the past 7 years, corporate tax revenues have mainly doubled. And indeed, throw the income taxes of individuals and other pro-growth measures, the entire database of federal tax revenue has increased by around 50%. So, how in the world can the CBO come back right away and now say that if Trump’s tax reductions are simply extended, the cost at 10 years will be 4 dollars? Cost of what? There is no cost.

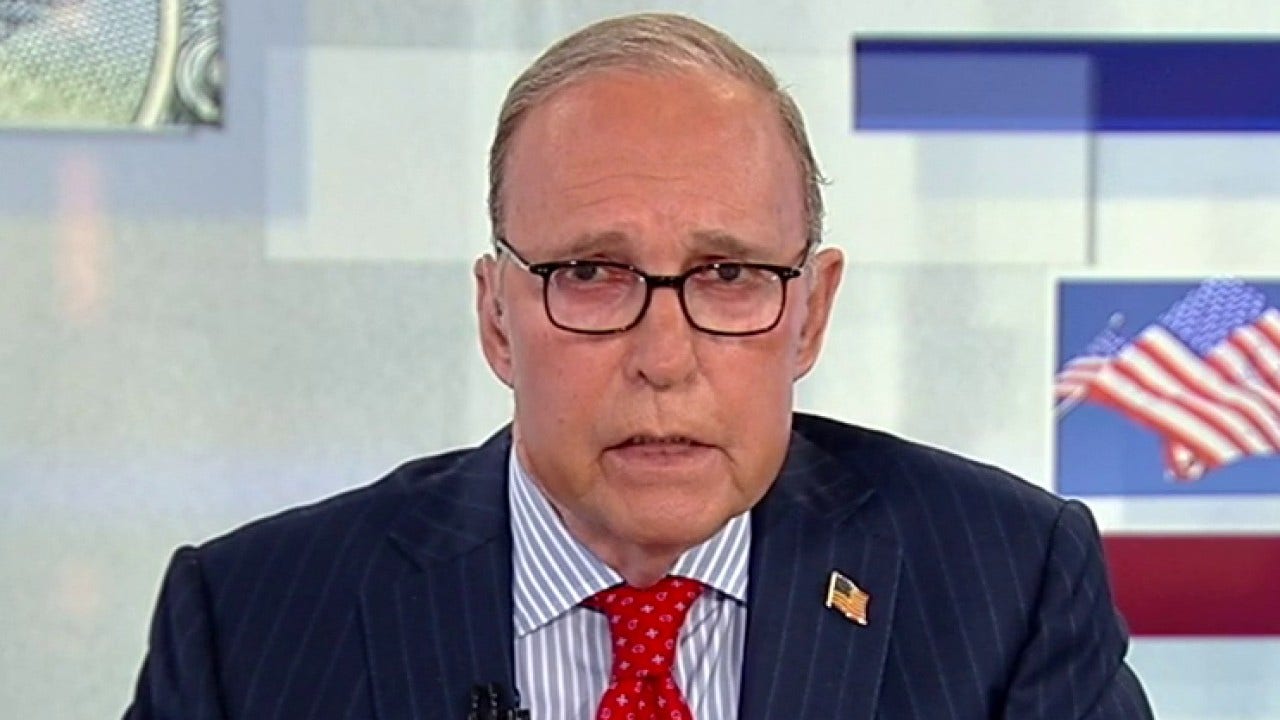

US Treasury Secretary Scott Bessent unpacking power prices in the world negotiations on “Kudlow”.

Keep low taxes and income will remain high. There will be less tax evasion and better growth. Laffer is right for about 50 years. The CBO has been false for about 50 years. And here is again, trying to tell us that the extension of Trump’s tax reductions will increase the budget deficit by 4 billions of dollars because the income will be lower.

It is an absolute nonsense and republicans in the chamber, the Senate and the White House should fight this nonsense CBO. Until now, one of the fighters has been the Senator Mike Crapo (R) of Idaho – who continues to assert that if you simply extend the current law, we do not increase taxes no taxes. There is no new deficit of 4 dollars. But if the tax bill is not extended, you will have an increase in taxes of 4 billions of dollars and this will worsen the budget deficit. Mr. Crapo calls on current policy and hopes that the Republicans will fight to officially modify the budgetary rules.

Senator Mike Crapo, R-Idaho, unpacks the proposal of the Taxes and Prices under President elected Donald Trump on “Kudlow”.

There is a previous one. In 2012, the Congress and President Obama extended the tax reductions of George W. Bush using the argument of current policy which assumed that the Bush tax cuts would continue – and not expire. Mr. CRAPO has repeatedly said that the CBO does not mark permanent expenses increases by hiking the deficit each year – and therefore they should not mark permanent tax increases. Otherwise, the entire federal budget system is like a freak on a permanent inclination: the always promoting higher taxes, higher expenses and even higher deficits.

Republicans should work hard to reduce unnecessary and counterproductive federal spending. They should reduce the size and scope of the government. But if they let the tax cuts expire, they will end up with a terrible economy and higher deficits at the same time.

He is a loser-percent.

Trump said we should never get bored to win. Let’s start by prolonging Trump’s tax cuts and increasing the economy by 3 – or maybe even 4% per year.

Call it the Boom of the Blue Cols.