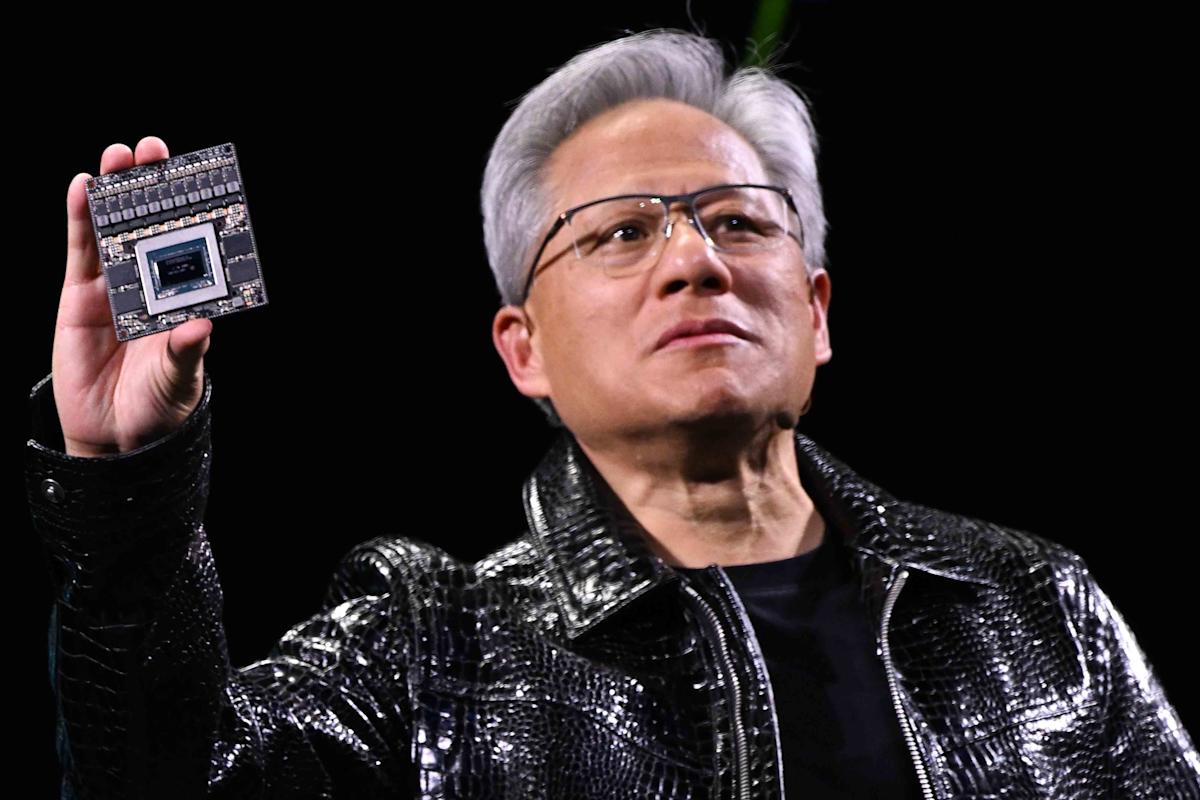

Nurphoto / Contributor / Getty Images

The CEO of Nvidia, Jensen Huang, during the opening presentation to these 2025 in Las Vegas, Nevada, January 6, 2025

This week’s post-benefit losses brought the Nvidia stock near the January levels that came after a deep dive.

Analysts have largely remained optimistic, pointing to the strong NVIDIA perspective on the back of the growing AI demand.

Several have also said they expect Nvidia to benefit from the emergence of Deepseek and increasing competition.

NVIDIA (Nvda) The stock experienced a difficult start until 2025, with this week The post-benfices plunge bring back the actions near the stockings which came after a Depth sale.

His actions were higher on Friday as a stock I found some support After plunging more than 8% on Thursday, but it has always left the stock approximately 7% lower for the week and the year. Analysts have has largely remained optimisticPointing towards Nvidia’s strong perspective on the back of the growing demand for AI.

Their optimism occurs while investors seem uncertain about the to come for recently high level actions, of which have added about half of their value in the last 12 months. Chinese startup DeepseekThe affirmations according to which his model of AI could follow American competitors to a fraction of the cost and that IT resources had raised concerns on demand for the most advanced chips of Nvidia could slow down, but several analysts said that they thought that Nvidia Betting to benefit the emergence of Deepseek and increasing competition.

When calling on Wednesday, CEO Jensen Huang said AI’s inference request accelerates As new models of emerging AI, giving a cry to the DEEPSEEK R1.

Deepseek “triggered global enthusiasm,” said Huang, adding that “almost all AI developers” apply R1 or adopt some of Deepseek’s innovations in their own technology. Rather than reducing the need for advanced fleas, said Huang, which leaves new generation navia for growth.

Citi and JPMorgan analysts said following the appeal that they had been reassured by Huang’s comments on Deepseek and the expected trajectory of computer needs. Wedbush analysts said they thought Nvidia will end up ending up with an “deep beneficiary”.

Bank of America analysts have suggested that competition from China could also push American companies to act with greater urgency on AI developments, rather than back spending. In recent income calls, several of the major Nvidia buyers, including Meta (Meta),, Microsoft (Msft),, Amazon (Amzn) and Google Parent Alphabet (Googl), did exactly that – the announcement of plans to increase their capital expenses to feed the AI ambitions.

Read the original article on Investigation