The CEO and founder of the DUB, Steven Wang, discusses his mission to create equality for each investor in America on Varney & Co.

The legendary investor, Warren Buffett, mocked President Donald Trump’s prices on Saturday and the tumultuous way in which the president deployed them.

Buffett, 94 years old, Chairman and Chief Executive Officer of Berkshire Hathaway, criticized the use by the Trump administration of prices as a commercial strategy, arguing that trade in trade as a “weapon” has an antagic of international relations and destabilized on the global markets.

“Balanced trade is good for the world” and “trade should not be a weapon,” said Buffett at the annual meeting of Berkshire Hathaway in Omaha, Nebraska, who attracts some 40,000 people each year who wanted to hear the billionaire magnate, including former secretary of state Hillary Clinton, who was also present.

The legendary investor Warren Buffett, on the left, kept the prices of President Donald Trump on Saturday and the tumultuous manner in which the president deployed them. Trump is represented to sign a decree on prices. (Reuters / Scott Morgan /, on the left, Andrew Caballero-Reynolds / AFP, Right, / Reuters Photos)

Warren Buffett says that prices are an economic “war”: “Tooth Fairy does not pay them” EM “

“I don’t think it’s a good idea to design a world where a few countries say, ha ha ha, we have won,” added Buffett. “I think the more the rest of the world becomes prosperous, … the more prosperous we will become.”

“The Oracle of Omaha” stressed the importance of balanced and mutually beneficial trade for all countries.

“This is a big mistake in my opinion when you have 7.5 billion people who do not like you very well, and that you have 300 million people who shocked the way they did,” added Buffet.

“We should try to exchange with the rest of the world. We should do what we do best and they should do what they do best,” he said.

Trump maintains that his rates are motivated by the fair trade for the United States.

But despite the concerns about the direction of the American economy and the country itself, Buffett has retained its traditional optimism, affirming the criticism of the policies and people who do them is normal for the course.

“We are still being changed,” he said. “I wouldn’t be discouraged … We are all very lucky.”

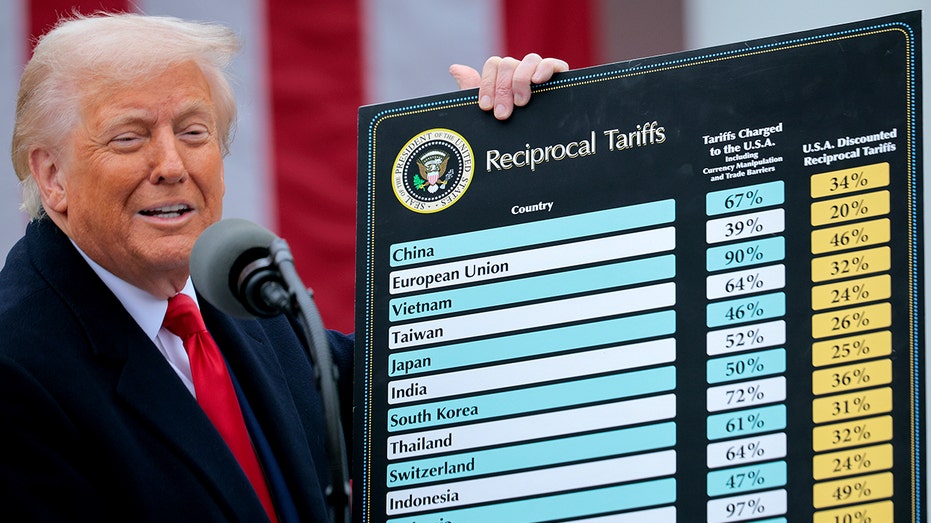

President Donald Trump speaks during a commercial event “Make America Richehy Again” in the Rose Garden at the White House on April 2, 2025 in Washington, DC. (Chip Somodevilla / Getty Images / Getty Images)

Warren Buffett, in annual letter, boasts the success of Berkshire Hathaway

This is not the first time that the legendary investor has returned to the prices. In March, before the announcement of Trump’s official price, said Buffet. The prices are “an act of war to some extent” and noted that the United States has a lot of experience with them.

“Over time, they are a tax on the goods. I mean, the fairy of the teeth does not pay them!” Said Buffett joking. “And then what? You should always ask this question in economics. You always say:” And what? “”

Berkshire Hathaway, a massive portfolio company that owns or invests in dozens of well-known companies, notably Geico, Dairy Queen, Apple, Coca-Cola and American Express, reported a significant drop in profits in the first quarter, winning $ 4.6 billion, against $ 12.7 billion the previous year.

Operating profits have also decreased by $ 14% to $ 9.6 billion, reflecting unrealized losses on actions such as Apple, with $ 860 million in Forest Forest Insurance Loss of California being a major factor, said the company.

BNSF Railroad, which belongs to the majority to Berkshire, has seen profits.

Berkshire’s cash participation increased from $ 334.2 billion at the end of the year. The company has not bought any title for a third consecutive quarter and was a net of shares seller for a 10th consecutive quarter.

The shareholders attend the annual assembly of shareholders of Berkshire Hathaway Inc, Omaha, Nebraska, United States, on May 3, 2025. (Photos Reuters / Brendan McDermid / Reuters)

Buffett minimized the concerns about Berkshire’s cash flow, saying that the company “approached” to spend $ 10 billion recently, but that purchasing opportunities are not presented. This should happen over five years, he said, but not necessarily tomorrow.

Warren Buffett, in annual letter, boasts the success of Berkshire Hathaway

Berkshire’s action has so far resisted a turbulent period for the markets, up 18.9% this year, while Standard & Poor’s 500 was down 3.3%.

Buffett reaffirmed its commitment to directing the Berkshire as long as its health allows it. He said he continued to invest and did not intend to retire.

Reuters contributed to this report.