(Bloomberg) – The sale which hammered the actions of Nvidia Corp. During last month, market technicians follow a key momentum indicator for signs of more problems to come.

Most of Bloomberg

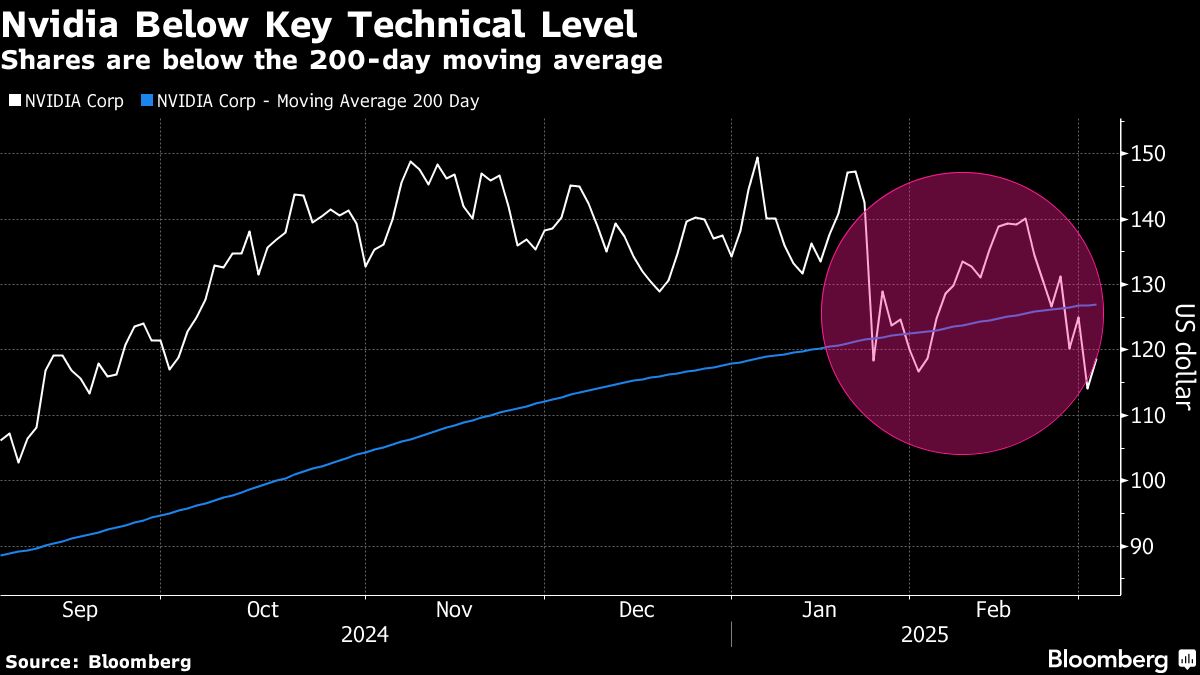

Graphics observers are obsessed with the 200 -day mobile average, a long -term mandomen measure that was raped in January for the first time in more than two years. While Nvidia increased modestly on Tuesday, the stock now merchanting well below the gauge, market professionals are obsessed with the trajectory of the mobile average.

“It is definitely a change of character compared to the last two years,” said Todd Sohn, Senior ETF and technical strategist at Strategas Securities LLC. “On a tactical basis, it is difficult to remain super optimistic about a name once the 200 days are starting to crest and hang down.”

Sohn says that the next level he looks at is $ 113 per share for Nvidia, the lower intraday he hit in a hollow in early February. Rick Bensignor, Chief Executive Officer of Bensignor Investment Strategies and former strategist of Morgan Stanley, has a similar area.

“I am inclined to think that there is more to do on the drawbacks,” said Bensignor. “We could see the support everywhere by $ 110, but below what my minimum downward goal is in the range from $ 107 to $ 103.” The next support is around $ 90, he added.

Nvidia’s actions changed between light gains and losses at the start of negotiations on Wednesday.

The slowdown of Nvidia occurred in the middle of a broader uncertainty of the market which is shaken most of the largest technological actions. The so -called magnificent group of technological megacaps recently fell on the correction territory – down more than 10% of its peak. The Nasdaq 100 index flirts with the same level.

Beyond the specific fears that have weighed on Nvidia since the emergence of Deepseek, there are also wider questions around President Donald Trump’s prices and exactly the quantity of technological companies – in particular those who have an exposure to China – would be affected.

NVIDIA is responsible for more than 30% of the drop in NASDAQ this year. Tesla Inc. and Broadcom Inc. are the second and third largest contributors to the slide, and both are also near their 200 -day mobile average.

“We may have seen a long -term peak in the stock. Nvidia remains the way to play AI and people continue to debate AI, “said Buff Dormeier, chief technical analyst at Kingsview Partners. “The stock seems tired in the longer term. The flattening of the 200 -day trend line is a sign that the momentum has weakened and things turn. »»