Madison Alworth of Fox Business explains how rental automobile companies have the opportunity to benefit financially from the automotive industry tariffs implemented by the Trump administration.

The automotive industry is preparing for the price increases of President Donald Trump’s prices which come into force this week. The important question that consumers wonder is: how much will they pay for a vehicle?

The answer is not easy, according to Brian Moody, editor -in -chief of autotrade. Moody explained that the effects of tariffs on national and international markets are more complex than consumers do it.

On the one hand, it is not because the United States requires that prices on all imported cars do not mean that the cost of cars made at the national level will remain the same while prices of cars abroad will increase. In addition, there will be no uniform increase at all levels, said Moody.

“It simply does not make sense to say that this car was built in the United States, no price increase. This car was built outside the price increase of $ 5,000

Trump, who considers prices as a means of bringing tax revenue for the tax reductions proposed while stimulating a revitalization of national manufacturing, plans to impose a rate of 25% on all imported passenger vehicles. This includes sedans, SUVs, multisgments, mini-duties, vans and light trucks. It will also support key automobile parts such as engines, transmissions, parts of the powertrain and electrical components, although there are “processes to extend prices to additional parts if necessary”.

Auto import prices of 25% of Trump: these are the most affected manufacturers

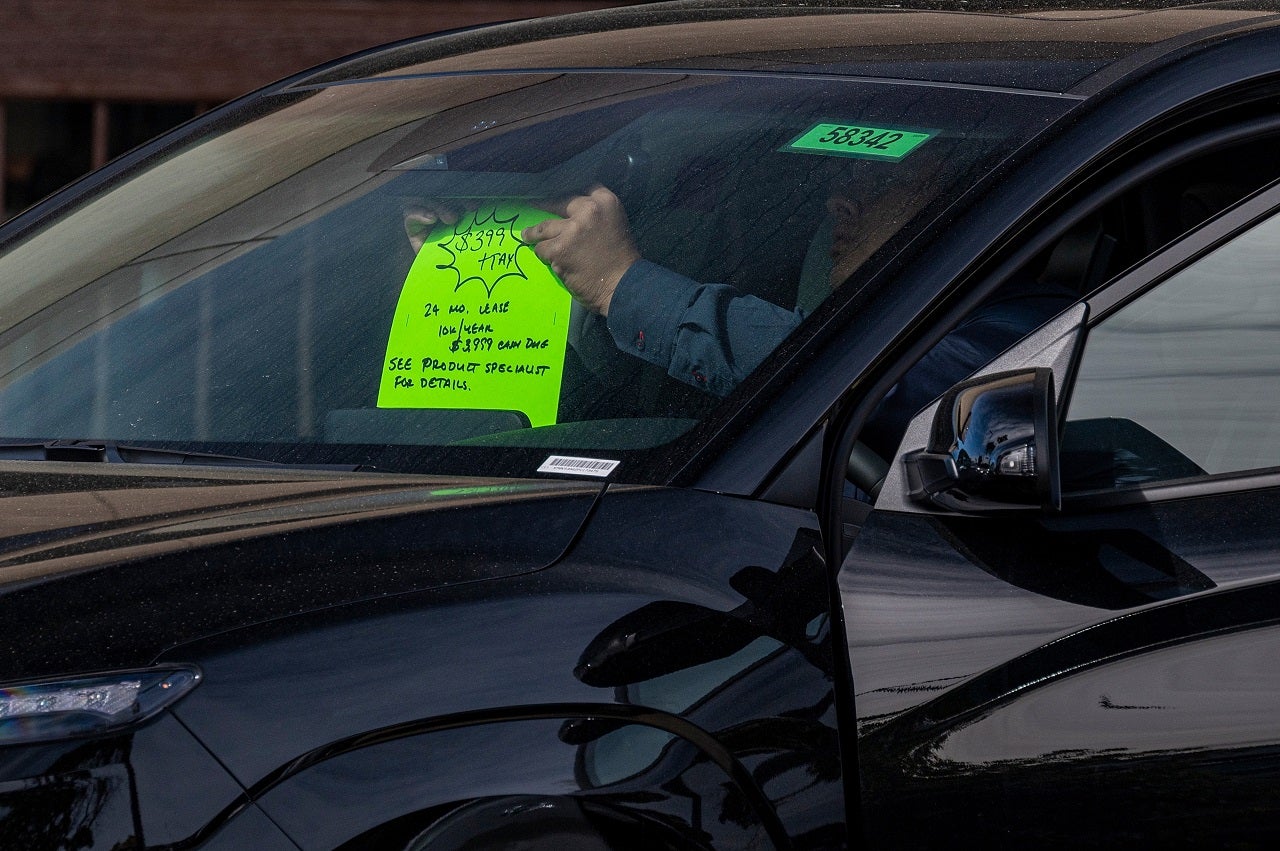

Used vehicles are presented for sale with a dealer in Colama, California. (David Paul Morris / Bloomberg via Getty Images / File)

Not only will Moody Project that prices will increase, but it plans that the increase will disproportionately affect high -end models, with more expensive vehicles probably knowing an even greater increase. For example, Moody explained that a car in the price range of $ 20,000 to $ 25,000 cannot support a significant price increase, while a car at $ 90,000 could do so.

Edison Yu, Deutsche Bank analyst, estimated that consumers could see an increase in prices of 5% to 10% on cars, although this can fall at the lower end if there is an exemption from the US-Mexico-Canada agreement, or more if there is none.

The administration said that automobile importers under the US-Mexico-Canada agreement, which are able to confirm the quantity of their cars made in the United States will receive exemptions. The systems will be put in place so that the 25% direct debit only applies to parts of the car that is not manufactured in the United States, the administration said.

Ford cars are presented to a dealership in Orland Park, Ill. (Daniel Acker / Bloomberg via Getty Images / File)

“It is not clear if this increase of 5% to 10% blows 100% for the consumer,” said Yu. “But my basic case would be the majority of this.”

Yu recognized it “could be very painful in the short term.” However, like Moody, he thinks there will be an imbalance and that some brands will be much more difficult. Hyundai, for example, will be the hardest reached. It is according to their analysis broken down by the vehicle and the region.

Trump car rates could be Boon for rental car companies

Yu explained that there is not much margin with whom to work in the supply chain and that car manufacturers will do their best so as not to absorb the increase in costs.

However, with prices set at 25% notable, “it is reasonable to expect vehicle prices to increase,” exacerbating the challenges in an “industry that is already struggling with affordable concerns in progress”, according to Jessica Caldwell, the head of Edmunds made it.

The average transaction price for new vehicles was $ 47,373 and the retail price suggested by the average manufacturer for new vehicles was $ 49,350, according to Edmunds pricing data in February. The average transaction price of used vehicles was $ 25,005.

Vehicles are presented for sale at a Honda Authority dealer in Fremont, California. (David Paul Morris / Bloomberg via Getty Images / File)

The administration said it uses tariffs on cars and automotive parts to protect and strengthen the American automotive sector.

Get Fox Affairs on the move by clicking here

The administration said that foreign automotive industries, which are reinforced by unjust subsidies and aggressive industrial policies, have expanded. At the same time, he said that American production had stagnated. In 2024, the Americans bought around 16 million cars, including SUVs and light trucks, but 50% of them were imports, the administration said.

Yu has recognized that around 46% of American cars sales are imported and that there is a desire to reduce this figure, but the only way to do so is “structural change of force”.

“What you end up with an American automotive industry which is much more integrated vertically and much more contained in the United States and we know in a way what it already looks like because, essentially, the Chinese automotive industry is like that,” he said, adding that the end of the game is to “lower much more than what we can now.”

Be that as it may, fear and uncertainty about prices have already led a handful of consumers to car dealerships. Tom Maoli, the owner of Celebrity Motor Cars, based in New Jersey, said sales have increased by 15% since last month.

Meanwhile, Deutsche Bank analysts expect the sales of April and May “are in fact robust while consumers buy ahead of the price increase”, according to a research note published on Sunday. They predict weakness in the second half of “once higher costs are starting to cross”.