Unlock the publisher’s digest free

Roula Khalaf, editor -in -chief of the FT, selects her favorite stories in this weekly newsletter.

The British economy contracted unexpectedly by 0.1% in January, stressing the challenge that the Chancellor faces Rachel Reeves while she is preparing to make a spring declaration with high issues this month.

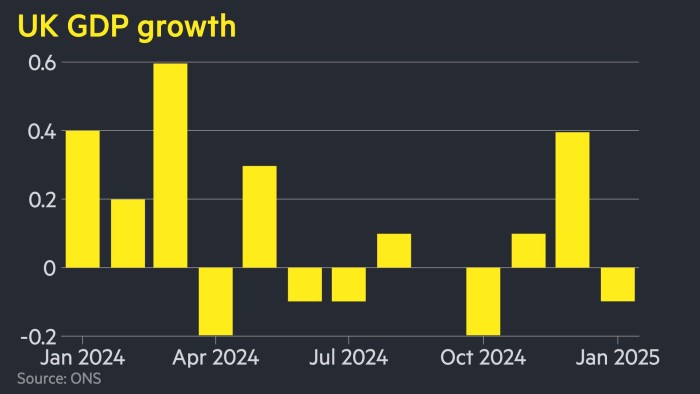

The monthly Friday GDP figure from The Office For National Statistics was lower than the growth of 0.1% expected by economists interviewed by Reuters and 0.4% of December. The drop was largely driven by the weakness of the production sector.

Reeves is preparing to slow down public spending in its spring declaration of March 26 after disappointing growth and the government’s loan figures aroused fears that it is on the right track to break its tax rules.

Growth has been largely at a standstill since May, reaching tax revenues, after the British economy rebounded after a technical recession at the beginning of 2024.

The fiscal liability office in October provides for economic growth for 2025 to 2% – double the 1% provided by economists questioned by Reuters. The guard dog is expected to publish a new forecast in parallel with the spring declaration.

SUREN THIRU, director of the economy of the Institute of Charterd Accountants, said that the contraction of the GDP of January had made the statement of spring of reeves “more problematic” because it increased the probability that the OBR decreases its forecasts, “more soiring the Chancellor’s spending plans”.

The pound was slightly weakened after the release of Friday data, down 0.2% compared to the dollar to $ 1.292. The licks were stable at the start of negotiations, with the yield at 10 years to 4.68%.

The figures occur while the fallout from Donald Trump’s escalation added to the economic strains facing the United Kingdom, as well as the higher prospect of defense spending, the American president disturbs Western security alliances.

“The world has changed and around the world, we feel the consequences,” said Reeves in response to Friday figures.

Consequently, she said: “We are launching the greatest sustained increase in defense spending since the Cold War, fundamentally reshaping the British state to deliver for workers and their families, and taking the blockers so that Great Britain is built”.

The Labor Party won the general elections last July with a promise to revive growth, but Reeves was criticized on its October budget, which left companies bearing the weight of 40 billion pounds sterling in the increase in taxes.

Companies warned of job cuts following measures, which take effect from April.

Paul Dales, Economic Consultation Economist, said that the drop in January production “highlights the weakness of the economy before the complete effects of the increase in commercial taxes and that the uncertain world fund is felt”.

The Bank of England is expected to maintain the rates pending at 4.5% at its meeting next week in the middle of the signs of an inflation rebound. Last month, the central bank reduced its economic growth forecasts for the first quarter from 2025 to 0.1%, against 0.4% expected in November.

Despite the January contraction, Thiru said that a drop in BOE rates next week was “unlikely” because the rate settings would likely like to assess the impact of the increase in national budget employers’ insurance contributions.

Friday data cemented the expectations of traders according to which there will be at least two other interest rate drops of a quarter of the BOE this year, with the thin chance of a third party, according to the levels involved by the Swaps markets.

According to Friday’s ONS data, the manufacturing sector contracted 1.1% in January, with a 0.2% drop in construction, while the services increased by 0.1%.

Liz McKewn, director of ONS economic statistics, said that the overall British economy table was “low growth”.

However, the services continued to grow in January, she said, “led by a solid month for retail stores, especially food stores, because people ate and drank more at home”.

The ONS said that the publication of commercial data, generally published alongside GDP figures, was delayed due to errors.