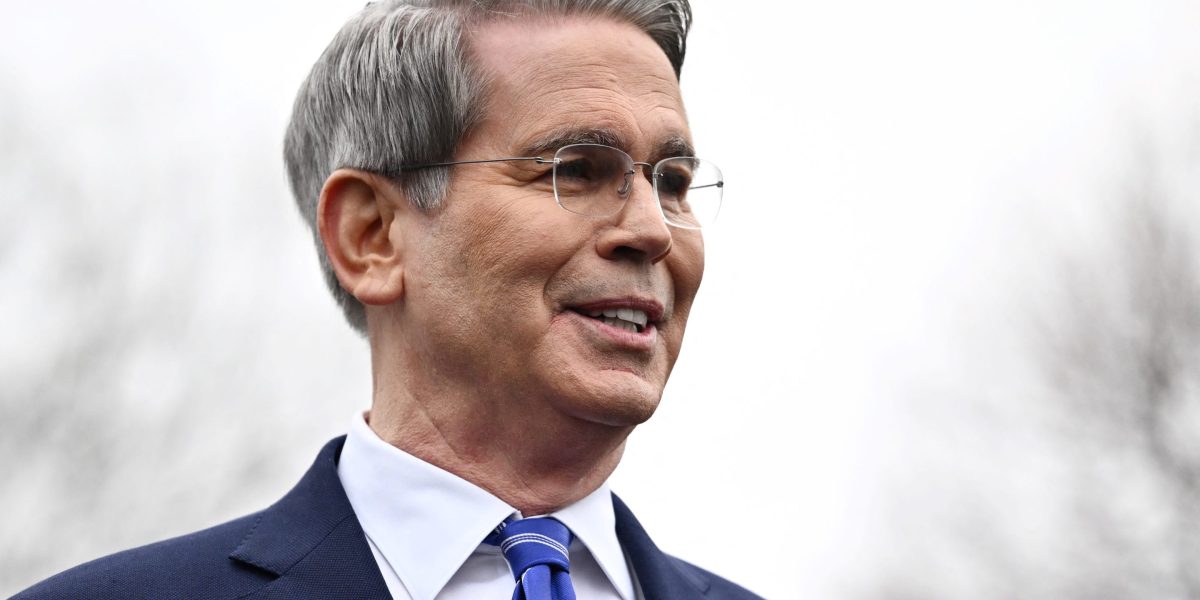

The secretary of the Treasury, Scott Bessent, a former hedge of hedge funds, said that he was not worried about the recent slowdown that suffered billions of dollars in the equity market while the United States seeks to reshape its economic policies.

“I have been in the investment sector for 35 years and I can tell you that the corrections are healthy, they are normal,” said Bessent on NBC on SundayMeet the press. “I do not worry about the markets. In the long term, if we set up a good tax policy, deregulation and energy security, the markets will be very good. »»

THEsaleThis made that the S&P 500 index in a correction last week came in the concerns of investors concerning the economic effects of the Trump administration movements around prices, immigration and cuts to the federal government. Losses on stock markets have deepened with growth problems and a bitter consumerfeeling.

“We put in place the policies that will bring down the affordability crisis, moderate inflation and when we set the sails, I am convinced that the American people will come to us,” said Bessent, who led the Key Square group before joining the administration.

While the scope of President Donald Trump’s pricing policy widens, consumers through the political spectrum are more and more concerned with the fact that additional tasks will cause higher costs. The global prices are now in place on steel and aluminum and there is a deadline of April 2 for even wider samples.

Find out more:Here is a count of Trump’s threats and pricing actions

While inflation has cooled last month, any sustained collection of prices pressure may limit discretionary purchases.

In the interview, Bessent said that the American dream is not subject to the possibility of buying cheap products in China. Families rather want to afford a house and see their children do better than them.

“These are mortgages, they are cars, they are real wage gains,” he said.

While questions about the American economy are built, managers of the federal reserve must meet this week. President of the Fed Jerome PowellunderlinesEarlier this month, the Central Bank does not need to be in a hurry to reduce rates, but it will probably be in a hurry for emerging uncertainty and risks.

This story was initially presented on Fortune.com