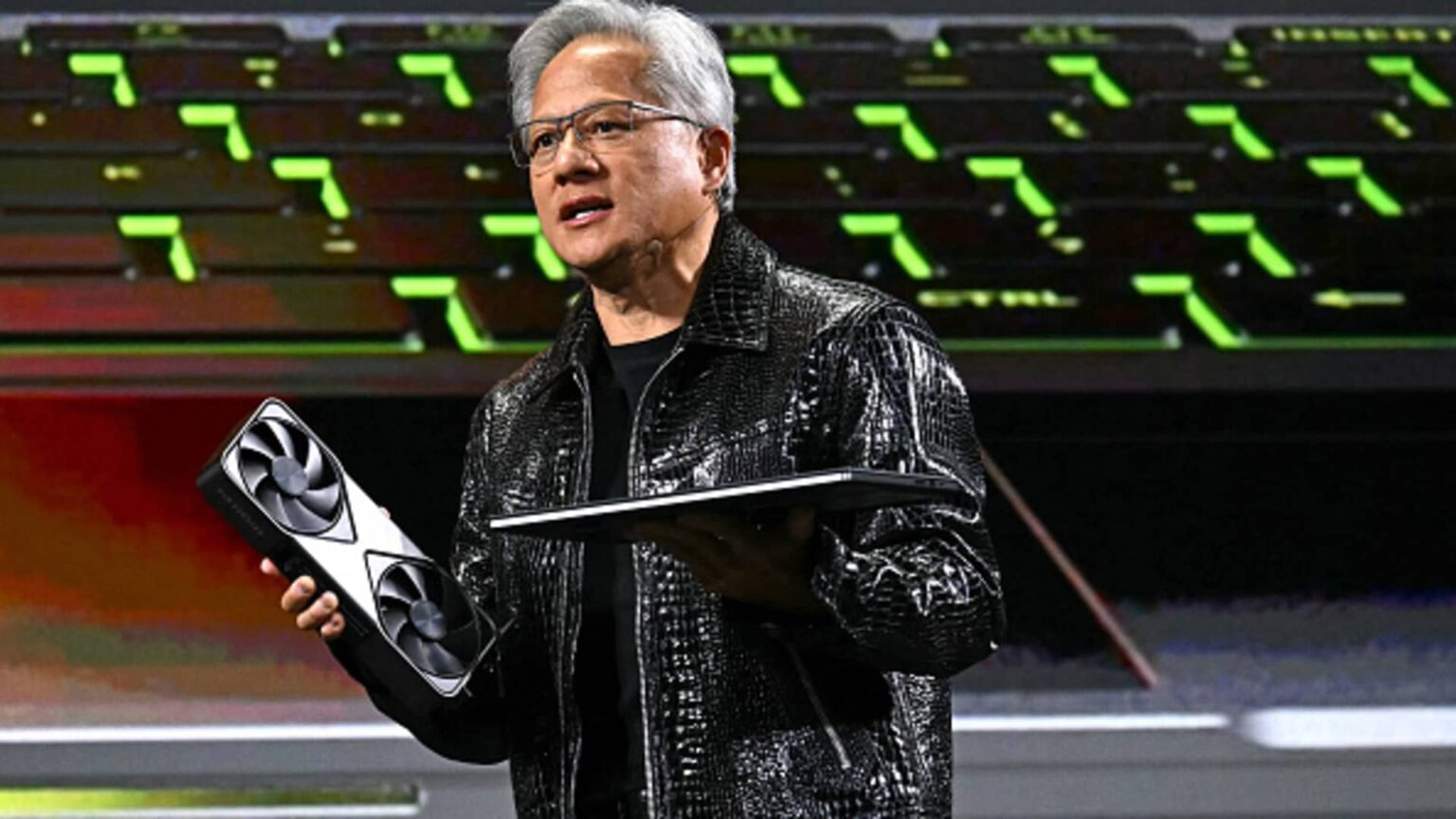

The CEO of Nvidia, Jensen Huang, holds a GPU (L) Blackwell GeForce RTX 50 and an RTX 5000 laptop while pronounces an opening address to the Consumer Electronics Show (CES) in Las Vegas, Nevada on January 6, 2025 .

Patrick T. Fallon | AFP | Getty images

Nvidia Lost nearly $ 600 billion in market capitalization on Monday, the largest drop in any one day in the history of the United States.

The chip manufacturer’s equity price dropped by 17% to end at $ 118.58. It was the worst day of Nvidia on the market since March 16, 2020, which was at the start of the cocovio pandemic. After Nvidia has exceeded Apple Last week, to become the most precious company listed on the stock market on Monday led a slide 3.1% in the NASDAQ in charge of technology.

The sale was triggered by concerns that the Chinese artificial intelligence laboratory Deepseek presents increased competition in the IA global battle. At the end of December, Deepseek unveiled a model of large free and open source language that He said only took two months and less than 6 million dollars to build, using chips with reduced capacity of Nvidia called H800S.

NVIDIA, or GPU graphic processing units dominate the ia data center flea market in the United States, with technology giants such as Alphabet,, Meta And Amazon Spend billions of dollars on processors to train and manage their AI models.

Cantor analysts wrote in a report on Monday that the publication of the latest Deepseek technologies caused a “great anxiety about the impact of the request for calculation, and therefore, fears of advanced expenditure for GPUs”.

Analysts said that they “thought that this point of view is most distant from the truth” and that AI’s progress will most likely lead to “the AI industry which wants more calculation, no less “. They recommend buying NVIDIA shares.

But after the enormous rupture of Nvidia – the title soaked 239% in 2023 and 171% in 2024 – the market is on the point of any possible decline in expenses. BroadcomThe other large manufacturer of American chips to see AI giant assessment gains, fell 17% on Monday, reducing its low capitalization by $ 200 billion.

Companies in the Data Center depositing NVIDIA GPUs for their equipment sales have also seen large sales. Apron,, Hewlett Packard Enterprise And Super micro computer abandoned at least 5.8%. OraclePart of the latest AI initiative by President Donald Trump fell 14%.

For Nvidia, the loss exceeded double the drop of 279 billion dollars that the company saw in September, which was the greatest loss of market value of a day in history at the time, deriving The loss of 232 billion Meta dollars in 2022. Before that, the most steep decline was 182 billion dollars per Apple in 2020.

Nvidia’s decline is more than double the market capitalization of Coca-Cola And Chevron and exceeds the market value of the oracle and Netflix.

The net value of CEO Jensen Huang has also taken a solid blow, decreasing about $ 21 billion, according to List of billionaires in real time of Forbes. The move downgraded Huang in 17th row on the richest list.

Sudden excitement around Deepseek over the weekend has pushed its application after the Openai Chatppt as the most downloaded free application in the United States on the Apple App Store. The development of the model occurs despite a multitude of recent borders on the exports of American fleas to China.

The venture capital David Sacks, who was exploited by Trump to be the AI and the Czar of the cryptography of the White House, Written on x This Deepseek model “shows that the AI race will be very competitive” and that Trump was right to cancel President Joe Biden’s executive decree last week on AI security.

“I am confident in the United States, but we cannot be complacent,” wrote Sacks.

Nvidia is now the third highest public company behind Apple and Microsoft.

WATCH: The full interview with CNBC with Stacy Rasgon by Bernstein