Regions like the United States and Europe have doubled on the reconstruction of its industrial muscle, after decades of closing factories and outsourcing of work to countries like China. To this end, a fast -growing Polish startup called NomagicWho builds robots – in particular robotic weapons – for logistical operations, announces $ 44 million in funding, money it will use for technology and commercial development, in particular the demarcation of its first efforts to sell its Robots to customers in regions outside of Europe, specifically North America.

The investment is essential not only for its size – the biggest tour for Nomagic to date – but because of which is funding and what is happening in the wider industrial landscape.

The perennial question that is asked about how to make the regions more competitive in the industry is again basic: how? A large part of the workforce that directed the factories and warehouses of the past has increased to other types of jobs; And when he did not do so, industrial operators have reduced the number of human workers to reduce costs and improve efficiency by providing more automation.

Sometimes, the currents of human workers in relation to technological innovation to improve efficiency have collapsed in a calamitic manner – testify to the viral history on the STARTUP Y combinator which aroused a working observer based on AI to Highlight when workers relax, a “sweatshop as a service”, as the critics have called it.

The simple fact of being indignant, unfortunately, does not mean that these types of technologies are not under construction, nor that humans will not become obsolete in certain functions … or, on the other hand, that someone does not Will not speak for them, their skills and work will continue and live to fight against another work dispute. But this indicates the debates and the difficulties in progress.

Nomagic’s financing, in part, seems to be a signal of the way some see the world that stands.

At the head of this series B is the VC arm of the European Bank for reconstruction and development. BERD is a co -owner development bank by more than 70 countries and two institutions of the European Union.

The involvement of the ERBD here underlines the push that governments and their institutions give in an attempt to stimulate private companies in order to rebuild industry: they see robotics and technology as an important lever to help to make Europe more competitive again in the industry.

In addition to the BVB, the higher and preceding donors Khosla Ventures and Almaz Capital participate, and in a final signal of institutional mission, the European Investment Bank (EIB) also launches the venture capital debt (the only type of ‘investment he tends to make).

By Pitchbook dataIt seems that Nomagic had collected about $ 30 million before (not counting the EIB debt), and while investors and the startup itself refused to give an evaluation, Khosla, Kanu Gulati, confirmed to Techcrunch Whether it was a “turn up” to start it. We have already profiled the startup and its technology here and here.

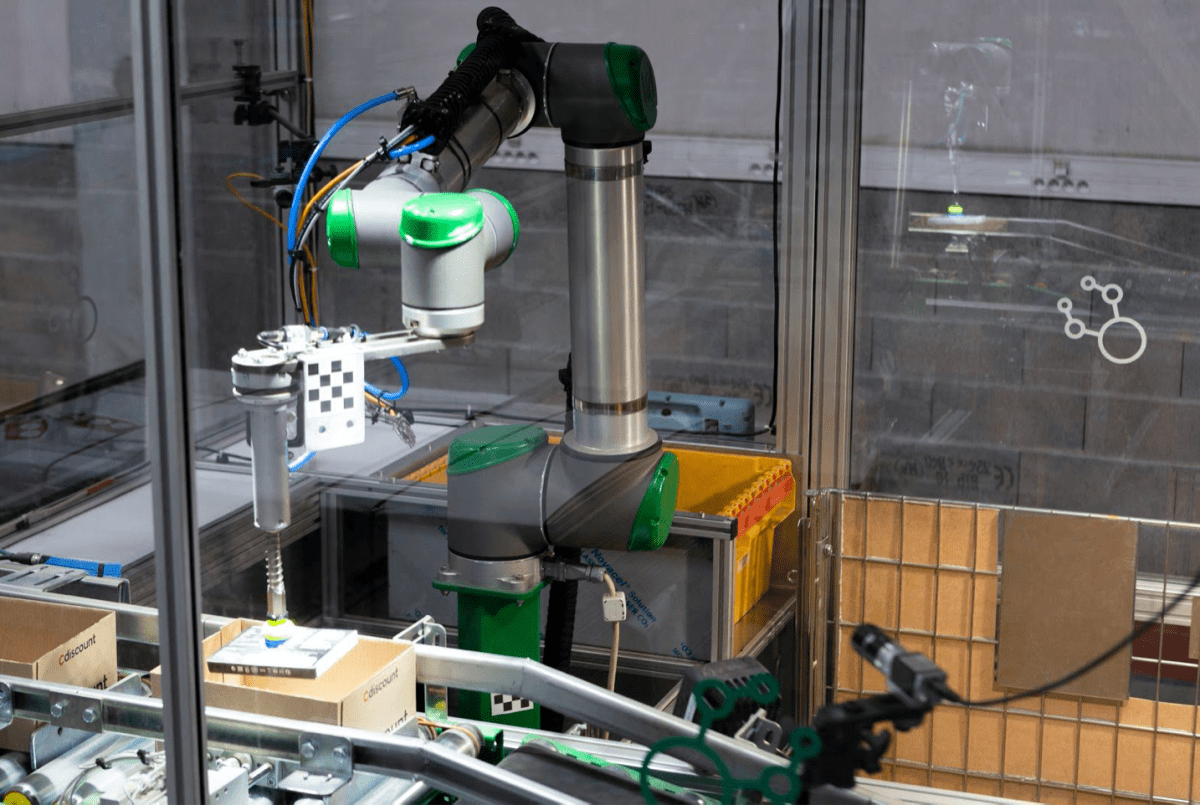

The key to note on Nomagic’s robotic arms is that they contrast, unlike many other robotics startups, not breakthroughs in the equipment.

“Most of our equipment is on the set,” said Kacper Nowicki – the CEO who co -founded the company with Marek Cygan (CTO) and Tristan d’Orgeval (CSO) – in an interview.

The objective of the company was rather placed on the software. By using computer vision, automatic learning and other types of automation, it has essentially built a “library” of different objects and how to move, pack them and manage them.

The robots are then fed by the Nomagic AI in a wide range of use cases and can be redeployed relatively easily on a case -by -case basis. This contrasts with the construction of many robotic and exploited arms, said Nowicki. D’Ogieval admitted that it was “contrary” but Nomagic has no interest in building humanoid robots, because many mobile parts are better served by wheels in industrial spaces.

The company claims to have increased its 220% annual recurring income in the past year (although it does not disclose a real number). It indicates that it is on the right track for 200% of the growth of the arrival this year on the back of the demand of new and existing customers in vertical sectors such as electronic commerce and pharmaceutical products.

Its customers include APO.com, Arvato, Asos, Brack, Fiege, Komlett or Vetlog.one, said the company.

Last year, the closest competitor to Nomagic was the subject of an interesting agreement with Amazon. Leviathan electronic commerce is a major robotics investor for his own warehouses, and in July 2024, it appeared that he had hired the founders of Covariant and concluded a major license agreement with the startup. It was not a complete acquisition, to be clear – Covariant still works as an independent company – but as a stage of what could be the evaluation of Nomagic, covariating would have was evaluated for the last time in 2022 at around $ 625 million.

Companies like Nomagic, covariant and others in space like Berkshire Gray and Righthand Robotics develop their technology at a time when robotics is increasingly making its brand in industrial environments.

The great players like Nvidia and Softbank (who acquired Berkshire Gray in 2023) identified the opportunity to build for the market, underlined by two currents: large companies slowly improve the inherited equipment; And just as important, they make a lot of noise around big bets as they and their partners build new physical spaces for manufacturing and logistics that will be green field opportunities for new equipment.

The role of the government should not be underestimated in this trend: the United Kingdom, the European Union, the United States and other regions all call for more investment in industry, and they will put more and more money behind this order.