Stay informed of free updates

Just register at American inflation Myft Digest – Delivered directly in your reception box.

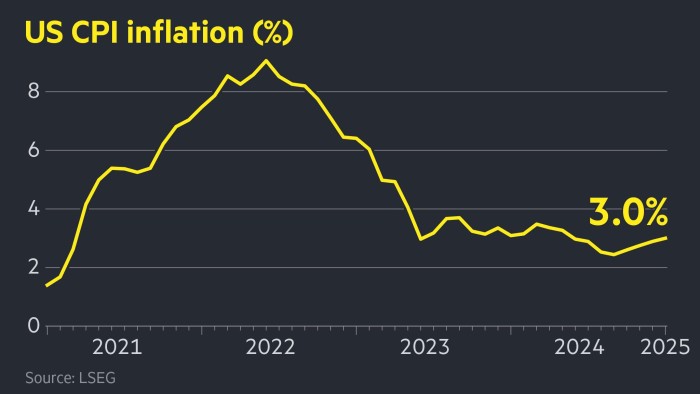

American inflation increased unexpectedly to 3% in January, strengthening the case so that the federal reserve takes place slowly with interest rate reductions and state bonds and obligations.

Wednesday’s Bureau of Labor Statistics figure exceeded the expectations of economists interviewed by Reuters, which predicted that inflation would remain stable at 2.9% of December.

The increase of the month over the month for January was also ahead of expectations, at 0.5%, against 0.3% planned.

The figures have led investors to bet that the Fed would reduce interest rates once this year. Before the publication of inflation data, the long -term market expected that the first decline arrives by September, with 40% of a second reduction by the end of the year.

“The markets are not convinced that we will see the disinflation later in the year, and the data of today certainly do not testify to that,” said Eric Winograd, chief economist of alliancebernstein, who stressed The concerns that “if inflation does not continue to lower, the Fed will not reduce rates at all”.

After the publication of data, the two -year yield on the obligations of the US Treasury, which follows the expectations of interest rates and passes inversely to Price, jumped from 0.09 percentage points to 4.37%.

The term contracts according to the S&P 500 Share index dropped by 1%, while those who follow the Nasdaq 100 of the technology decreased by 1.1%. A dollar gauge against six other currencies jumped 0.5%.

Inflation data intervenes after the FED challenged President Donald Trump’s calls to make high borrowing costs and rather held its main rate of 4.25% to 4.5%.

On Tuesday, the president of the Fed, Jay Powell, told Congress that the Central Bank would continue to “do our job and stay outside of politics”.

But Wednesday, Trump renewed his requests on his social platform for truth. “Interest rates must be reduced, something that would go hand in with the prices to come !!!” The American president posted. “Allows Rock and Roll, America !!!”

Wednesday data will feed concerns among economists that the world’s greatest economy heats up, while Trump is advancing with prices’ sweeping plans, repression against immigration and large tax reductions which, according to economists , could trigger a new increase in inflation.

Since his return to the White House on January 20, Trump has already started implementing mass deportations of undocumented immigrants and has imposed tariffs of 10% on Chinese imports.

He also announced that samples raised on almost all imports from Canada and Mexico, as well as on all imports of steel and aluminum, would take effect in March.

Powell said it was still too early to judge the impact of the prices on the economy and monetary policy, as it would depend on the details of the samples.

Whitney Watson at Goldman Sachs Asset Management said that, with the robust state of the American job market, Wednesday inflation figures were likely to strengthen “the prudent flexibility” approach “. She added: “We think the Fed is likely to stay in” waiting “fashion for the moment.”