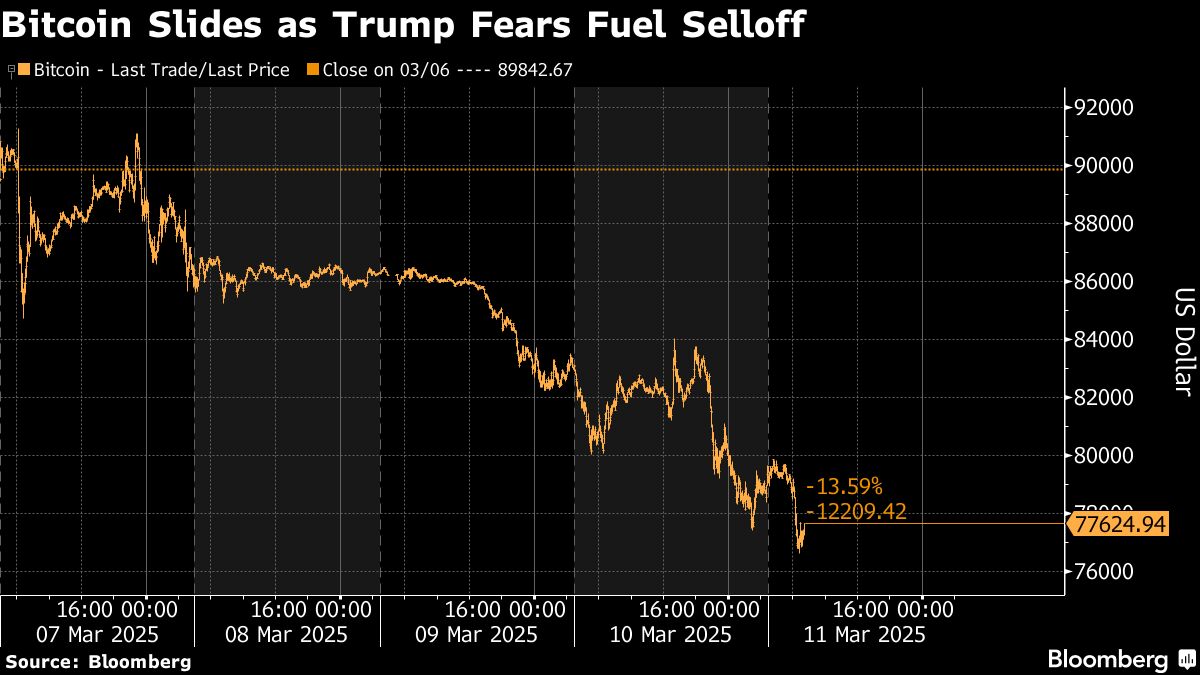

(Bloomberg) – Cryptocurrencies have slipped as fears about the sale of American actions have overshadowed President Donald Trump’s recent efforts to support the industry.

Most of Bloomberg

Bitcoin fell by more than 3% Tuesday morning in Asia, while the second-row token ether dropped up to 6% at $ 1,756, an intra-day hollow not seen since October 2023, according to data compiled by Bloomberg. The two tokens then made these losses.

The initial declines occurred after the sale of American actions led by technological actions have taken steam. The Nasdaq 100 index, heavy with technology, has plunged 3.8% for its worst day since October 2022. Wall Street is nervous after Trump warned that Americans can feel a “little disturbance” resulting from commercial wars with Canada, Mexico and China. Wall Street’s strategists and economists have increased their chances for an economic slowdown in the United States.

“Now that the industry has its strategic Bitcoin reserve management decree, Crypto has a catalyst before less positive for prices, and we are at the mercy of macro-risk appetites,” said the Co-chef de Falconx Global of the markets, Joshua Lim.

Trump ordered the creation of an American Bitcoin reserve and a stock separate from other tokens before a top of high -level crypto with industry leaders in Washington on March 7 – very steeled movements that finally made much to raise the feeling of the market. The order has authorized the Treasury and Trade services to develop “neutral budget strategies” to buy more bitcoin, which means that the government will not acquire additional crypto for stock.

Hayden Hughes, responsible for cryptographic investments at Family Office Evergreen Growth, said that “the market now seems to be reacting negatively” when the reserve was announced. “But in my opinion, it is really an exaggeration and the market now appears deeply occurring,” he added.

Among the biggest losers in the sale of Monday on a market scale, there were negotiated funds on the stock market that seek to offer juice yields on digital assets or themes related to crypto. Two ETFs made betting on the strategy – the Bitcoin relaxation company formerly known as Microstrategy – fell by more than 30% for the day.

Bitcoin was traded at $ 79,300 at 10:52 a.m. Tuesday in Singapore. The largest digital asset should find support at $ 73,000 and $ 70,000, according to Hughes. “There will be strong purchases there,” he said.