- While the stock market remains volatile In the midst of the consequences of the so-called rates of the “liberation day” of President Donald Trump, consumer spending has not been significantly affected, at least not yet. During quarterly profits, credit card companies offered solid prospects for consumption spending, but many have taken measures to mitigate losses in the midst of potential economic slowdown.

As the trade policies of President Donald Trump contributed to stock market disorders, the fallout from his so -called “Liberation Day” prices have not yet reached the quarterly financial reports of the largest lenders in the country where consumer spending models are often the first to emerge

Profits reports for credit card companies have remained solid, consumers, consumers have borrowed, spent and opened credit cards more than the previous year.

“The consumer continues to be resilient and demanding in his expenses,” said Citigroup’s financial director Marton, during the company Call of quarterly results Last week. Mason also underlined a revised feeling of consumers.

“We have seen an evolution towards the essential elements and far from travel and entertainment,” said Mason.

JPMorgan Chase reported a 7% increase in credit and debit card expenses from one year to the next, but people noted high credit card sales. In addition, Bank of America described a bump of 4% of credit card and debit expenses compared to a year earlier coupled by a drop in late payments for loan holders during the previous quarter.

Despite a positive growth, large credit card companies are preparing for an economic slowdown and the delinquentes are already reaching their highest level in five years.

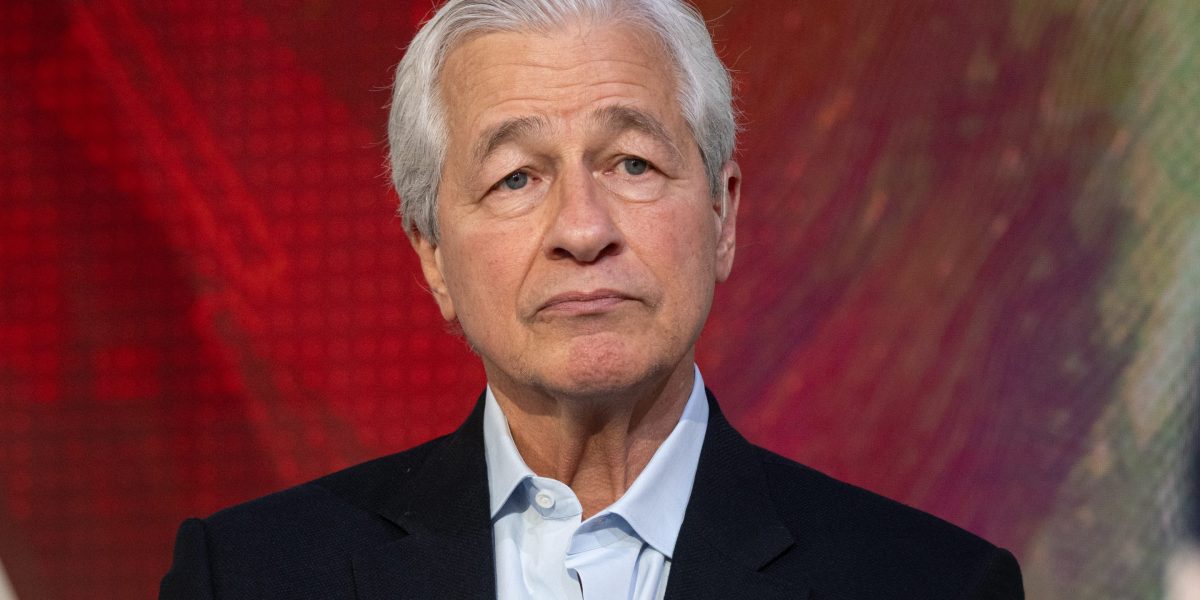

“The emphasis is put on the future, which is obviously unusually uncertain,” said JPMorgan Chase finance chief Jeremy Barnum profit call April 11.

As JPMorgan has the risk of 60%recession, the bank added to its Rain Day Fund In the event of future loss by increasing its allowance for credit loss (ACL) of $ 973 million, bringing its total net reserve to $ 27.6 billion. ACL acts as a stamp to cover these losses if customers do not pay their credit card invoices.

In addition, the company allocated $ 3.3 billion to its loan loss provisions – an increase of 73% compared to the $ 1.9 billion issued to combat unpaid loans per year. JPMorgan also maintains 1.5 billion of dollars in cash and marketable securities.

JPMorgan did not immediately respond to Fortune Comment request.

In addition to JPMorgan, Citi maintains security if an economic slowdown occurs. The bank increased its credit cost by more than 15% compared to the previous year to 2.7 billion dollars.

In addition, Citi increased its total reserves by $ 1 billion in the first quarter, going from $ 21.8 billion to $ 22.8 billion, looking for a warranty if the US economy goes south. The bank also maintains high liquidity and a capital position with cash levels reaching $ 960 billion.

Citi did not return immediately Fortune Comment request.

This story was initially presented on Fortune.com